You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tomorrow (Dec 14) is the big day - two new Canon lenses to be released!

- Thread starter West Coast Birder

- Start date

Wilt

Member

sales tax rates in 2023I wonder how prices compare if you include sales tax for US goods especially in large cities like LA or NY. I'm guessing it's going to be close.

Chicago = 10.25%

Los Angeles = 9.5%

Atlanta = 8.9%

NYC = 8.875%

San Francisco = 8.625%

Dallas = 8.25%

Miami = 7%

Portland = 0%

- Joined

- 6 Nov 2023

- Posts

- 964

- Likes

- 1,496

- Image Editing

- Yes

What's the best camera store to use in the EU? I did a little poking around and it seems that cameras in the EU are closer than I though when tax is factored in. For example, at B&H the Canon EOS R6 Mark II can be had for 2299 USD. At Park cameras London, the same camera is 2579 EUR, but that's pre-sales tax. If I purchase it in LA, add another 218 USD making it 2517 USD. Plug those into an exchange rate calculator and I get 2294 eur. Cheaper but not a lot cheaper.

Capn Jack

Gold Member

It ain't necessarily so.What gets imported into EU from outside EU are taxed, as an effort to keep the system fair for EU producers so that they can compete on equal terms on the European market with suppliers situated outside the EU

It depends on the Harmonized Code for a product, treaties and politics. When I ship something to the EU, I often need to work with our customer service group to choose the correct code that makes sense legally, yet minimizes the duty. An object could be described with different harmonized codes which have vastly different duties! The duty owed ranges from 0 to much higher numbers (I forget how high). I shipped some purified RNA to a customer and the duty on "nucleic acid" was lower than many other chemicals, enough that it was nearly negligible. Another example from last year involved a tradeshow. The booth across from mine was giving little plush tigers as a premium. Someone at her company shipped the gifts from China and they were hit with a very high duty because they listed the harmonization code for "toys". She was really annoyed because she told them the proper code. It's just like here in the USA- different goods and services have different duties depending on their harmonization code, most favored nation status, and politics.

Capn Jack

Gold Member

When I shop in the UK or EU, there is no sales tax added on because the VAT is "hidden in the price". It's like buying gasoline here- all the road taxes and other taxes aren't listed- we only see the total price per gallon. The price of the camera should be 2579 pounds, not Euros, unless you see an advertisement intended for the EU market. As of today, 1 pound is 1.16 euro.What's the best camera store to use in the EU? I did a little poking around and it seems that cameras in the EU are closer than I though when tax is factored in. For example, at B&H the Canon EOS R6 Mark II can be had for 2299 USD. At Park cameras London, the same camera is 2579 EUR, but that's pre-sales tax. If I purchase it in LA, add another 218 USD making it 2517 USD. Plug those into an exchange rate calculator and I get 2294 eur. Cheaper but not a lot cheaper.

Capn Jack

Gold Member

Don't forget the state sales tax. For California, that is 7.25%, separate from the local taxes you posted.sales tax rates in 2023

Chicago = 10.25%Los Angeles = 9.5%Atlanta = 8.9%NYC = 8.875%San Francisco = 8.625%Dallas = 8.25%Miami = 7%Portland = 0%

Wilt

Member

But it is not 7.25% on top of the rates that I posted...what I posted iare INCLUSIVE of state sales tax...that is what explains the difference between San Francisco and LA, for example. There local taxes might be assessments for local projects, or transit districts to fund mass transit, etc. and generally add fractions of a percent in addition to the 7.25% base rate, each one accumulating to add 2% or more aggregate in some cases. Where I reside it totals 9.88%, and we are a half hour from San Francisco at 8.625%...we have a local public library building, a local sports complex for our community of 25000.Don't forget the state sales tax. For California, that is 7.25%, separate from the local taxes you posted.

- Joined

- 6 Nov 2023

- Posts

- 4,223

- Likes

- 4,833

- Location

- Amsterdam, The Netherlands, EU

- Name

- Levina

- Image Editing

- No

JJ, we are not a United States of Europe, but are all independent countries and each have their own stores.What's the best camera store to use in the EU? I did a little poking around and it seems that cameras in the EU are closer than I though when tax is factored in. For example, at B&H the Canon EOS R6 Mark II can be had for 2299 USD. At Park cameras London, the same camera is 2579 EUR, but that's pre-sales tax. If I purchase it in LA, add another 218 USD making it 2517 USD. Plug those into an exchange rate calculator and I get 2294 eur. Cheaper but not a lot cheaper.

Park cameras is UK, not EU (Brexit, remember?) and their prices are in British pounds.

Capn Jack

Gold Member

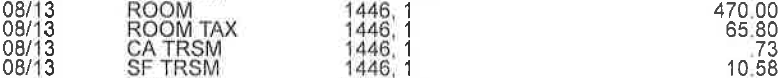

Here's part of a bill from a visit to San Francisco from this August.But it is not 7.25% on top of the rates that I posted...what I posted iare INCLUSIVE of state sales tax...that is what explains the difference between San Francisco and LA, for example. There local taxes might be assessments for local projects, or transit districts to fund mass transit, etc. and generally add fractions of a percent in addition to the 7.25% base rate, each one accumulating to add 2% or more aggregate in some cases. Where I reside it totals 9.88%, and we are a half hour from San Francisco at 8.625%...we have a local public library building, a local sports complex for our community of 25000.

$65.80 is pretty close to 14%- less than ~16% I would expect, but more than ~8.6% for sure!

Adding in the other taxes brings the total up to the expected ~16 %

Last edited:

- Joined

- 6 Nov 2023

- Posts

- 964

- Likes

- 1,496

- Image Editing

- Yes

Most cities charge additional taxes on hotels/motels.Here's part of a bill from a visit to San Francisco from this August.

View attachment 15423

$65.80 is pretty close to 14%- less than ~16% I would expect, but more than ~8.6% for sure!

Adding in the other taxes brings the total up to the expected ~16 %

Wilt

Member

Taxes on hotel stays are a totally different animal from Sales Tax on goods, and can also vary widely from one community to another...there is no correlation to Sales Tax assessments at the state and local level, but are levied as an additional income source...room tax, tourism tax at state level, tourism tax at the city level.Here's part of a bill from a visit to San Francisco from this August.

View attachment 15423

$65.80 is pretty close to 14%- less than ~16% I would expect, but more than ~8.6% for sure!

Adding in the other taxes brings the total up to the expected ~16 %

- Burlingame has 12% hotel occupancy tax, its Sales Tax is 9.63% ,

- its neighbor to the south San Mateo has 14%. Lost Angeles has 15.5% hotel occupancy tax, Sales Tax is 9.38%.

- Belmont also has 14% hotel occupancy tax , Sales Tax is 9.88%

- Los Angeles has 14% hotel occupancy tax with added 0.3% CA tourism fee and LA tourism fee of 2% , Sales Tax is 9.38%.

Last edited:

Capn Jack

Gold Member

Taxes on hotel stays are a totally different animal from Sales Tax on goods, and can also vary widely from one community to another...there is no correlation to Sales Tax assessments at the state and local level, but are levied as an additional income source...room tax, tourism tax at state level, tourism tax at the city level.

- Burlingame has 12% hotel occupancy tax, its Sales Tax is 9.63% ,

- its neighbor to the south San Mateo has 14%. Lost Angeles has 15.5% hotel occupancy tax, Sales Tax is 9.38%.

- Belmont also has 14% hotel occupancy tax , Sales Tax is 9.88%

- Los Angeles has 14% hotel occupancy tax with added 0.3% CA tourism fee and LA tourism fee of 2% , Sales Tax is 9.38%.

This one looks like almost 16% total tax, , with a 4% SF mandate added in before the tax

Wilt

Member

View attachment 15589

This one looks like almost 16% total tax, , with a 4% SF mandate added in before the tax

Restaurants in SF pose a puzzle even for residents, much less for visitors from Europe where service has been included for so long (although I am puzzled as a US resident in visiting Netherlands in June 2023, in which it seemed that NONE of the restaurants automatically included a 'service' mentioned as included)... SF mandated that SF restaurants include benefits to its wait staff, so many (but not necessarily all) restaurants included the mandated costs as an identifiable surcharge listed separately from food & drink cost. The 'SF Mandate' is specifically for healthcare benefits, which requires those firms employing 20 or more employees to contribute a minimum amount to health benefits per employee-hour...Those companies with 20 to 99 employees, they were required to contribute at least $1.17 per worker-hour, yet this healthcare benefit is often referred to as and a 5% San Francisco health mandate fee with your bill, adding vagueness to the matter...why is it stated as 4% on your bill?!

Some other restaurants now automatically add a 'service charge', some add a 'dine in fee', as a separate manner of increasing the pay received by wait staff without their food prices seeming to have increased a great leap.

Mystery San Francisco Restaurant Bill Surcharges Explained

What are those surcharges and extra fees on your restaurant bill?

Last edited:

Capn Jack

Gold Member

That seems to be a North American thing. I don't see surcharges in Europe or Asia. They will sometimes have taxes. PR China is particularly easy for expense reports because the bill was simply the price per night (inclusive of everything) and it was the same each night! I could ask "客房一夜多少钱?" and the bill matched the number I was told! We have these in Lincoln- There is an "arena tax" to pay for a new arena, and one shopping center has its very own parking tax to pay for a new parking garage, where you can park for "free".although I am puzzled as a US resident in visiting Netherlands in June 2023, in which it seemed that NONE of the restaurants included a service charge?!)

Back to the conversation about sales tax, I'll note that 20.02 *(0.0725+0.08625) -> 3.178175 -> $3.18 so you listed the correct sale tax rates for both California and San Francisco.

Wilt

Member

I am accustomed, from my travels around the world over the past 50 years, to seeing things on the restaurant tab with explainations like "Service est compris" on French tabs ("service is included"), but did not find similar notice in Netherlands... so one simply 'has to know' the conventions.That seems to be a North American thing. I don't see surcharges in Europe or Asia. They will sometimes have taxes. PR China is particularly easy for expense reports because the bill was simply the price per night (inclusive of everything) and it was the same each night! I could ask "客房一夜多少钱?" and the bill matched the number I was told! We have these in Lincoln- There is an "arena tax" to pay for a new arena, and one shopping center has its very own parking tax to pay for a new parking garage, where you can park for "free".

Back to the conversation about sales tax, I'll note that 20.02 *(0.0725+0.08625) -> 3.178175 -> $3.18 so you listed the correct sale tax rates for both California and San Francisco.

It used to be rather universal in US restaurants to simply 'know' that the convention is the restaurant tab was food, plus any stated taxes, but one had to leave a tip (assumed to be around 15%) in addition to the restaurant bill, or if the dinner group was above a certain number of people the restaurant would have an explicitly stated preset percentage added separately for service fee (more like the European convention). Now places like San Francisco make it confusing because there is not a standardized presentation...

- a small SF restaurant with dozen employees serving 4 people states only food+beverage, tax, but nothing for 'service' so the diner is expected to add in 15-20% tip

- and the same small SF restaurant with dozen employees serving 10 people states food+beverage, tax, and a line for '20% service charge' so the diner adds no tip (unless they feel they got exceptionally well treated by the wait staff)

- a second small SF restaurant with dozen employees serving 4 people states food+beverage, tax, and a line for 'service charge' so the diner adds no tip (unless they feel they got exceptionally well treated by the wait staff)

- a third small SF restaurant with dozen employees serving 4 people states food+beverage, tax, and a line for 'service charge' so the diner adds no tip (unless they feel they got exceptionally well treated by the wait staff)

- a SF restaurant with 30 employees serving 4 people states food+beverage, tax, and 5% SF Mandate service' which covers healthcare benefits cost, but the diner is still expected to add in 15-20% tip for the otherwise underpaid staff.

- another SF restaurant (like your displayed receipt) with 30 employees serving 4 people states food+beverage, tax, and only 4% SF Mandate service', but the diner is still expected to add in 15-20% tip for the otherwise underpaid staff.

- the same SF restaurant (like your displayed receipt) with 30 employees serving 10 people states food+beverage, tax, and only 4% SF Mandate service', and adds a line for '20% service fee' (and the diner is NOT expected to add in tip for the staff).

Europe is somewhat uniform

- a restaurant in France states food+beverage cost with note 'service est comprise', so diner adds no money for service but 'rounds up'

- a restaurant in Netherlands states food+beverage cost with no note about service inclusion, so diner (tourist from US) adds no money for service(?) but 'rounds up' like elsewhere in Europe?!

Last edited:

Capn Jack

Gold Member

And you are correct about the state and sales tax being added together too- 7.25% state + 8.625 % city -> $3.18, 15.875% total tax.I am accustomed, from my travels around the world over the past 50 years, to seeing things on the restaurant tab with explainations like "Service est compris" on French tabs ("service is included"), but did not find similar notice in Netherlands... so one simply 'has to know' the conventions.

It used to be rather universal in US restaurants to simply 'know' that the convention is the restaurant tab was food, plus any stated taxes, but one had to leave a tip (assumed to be around 15%) in addition to the restaurant bill, or if the dinner group was above a certain number of people the restaurant would have an explicitly stated preset percentage added separately for service fee (more like the European convention). Now places like San Francisco make it confusing because there is not a standardized presentation...

...and the diner has to figure out just which situation applies, and (especially for someone who does not speak English as second language, but even for English speaking residents) they can readily underpay or overpay because it is not necessarily clear that health benefits coverage in SF still does not get them above minimum wage earnings!

- a small SF restaurant with dozen employees serving 4 people states only food+beverage, tax, but nothing for 'service' so the diner is expected to add in 15-20% tip

- and the same small SF restaurant with dozen employees serving 10 people states food+beverage, tax, and a line for '20% service charge' so the diner adds no tip (unless they feel they got exceptionally well treated by the wait staff)

- a second small SF restaurant with dozen employees serving 4 people states food+beverage, tax, and a line for 'service charge' so the diner adds no tip (unless they feel they got exceptionally well treated by the wait staff)

- a third small SF restaurant with dozen employees serving 4 people states food+beverage, tax, and a line for 'service charge' so the diner adds no tip (unless they feel they got exceptionally well treated by the wait staff)

- a SF restaurant with 30 employees serving 4 people states food+beverage, tax, and 5% SF Mandate service' which covers healthcare benefits cost, but the diner is still expected to add in 15-20% tip for the otherwise underpaid staff.

- another SF restaurant (like your displayed receipt) with 30 employees serving 4 people states food+beverage, tax, and only 4% SF Mandate service', but the diner is still expected to add in 15-20% tip for the otherwise underpaid staff.

- the same SF restaurant (like your displayed receipt) with 30 employees serving 10 people states food+beverage, tax, and only 4% SF Mandate service', and adds a line for '20% service fee' (and the diner is NOT expected to add in tip for the staff).

Europe is somewhat uniform

- a restaurant in France states food+beverage cost with note 'service est comprise', so diner adds no money for service but 'rounds up'

- a restaurant in Netherlands states food+beverage cost with no note about service inclusion, so diner (tourist from US) adds no money for service(?) but 'rounds up' like elsewhere in Europe?!

As for the rest of it, it really isn't difficult. The SF mandate is part of the price of the food, so is included in the total price so I tip on that amount depending on service (service wasn't very good there at the place I posted). If someplace mentions a service charge, I don't leave a tip either.

As my photographs show, I've been around the world too and it isn't that difficult to understand the tipping culture. If they want a tip, they leave a line so it can be charged to the credit card

Wilt

Member

And you are correct about the state and sales tax being added together too- 7.25% state + 8.625 % city -> $3.18, 15.875% total tax.

As for the rest of it, it really isn't difficult. The SF mandate is part of the price of the food, so is included in the total price so I tip on that amount depending on service (service wasn't very good there at the place I posted). If someplace mentions a service charge, I don't leave a tip either.

As my photographs show, I've been around the world too and it isn't that difficult to understand the tipping culture. If they want a tip, they leave a line so it can be charged to the credit card

- In San Francisco, sometimes the added fee only pays for healthcare benefits, but usually there are no medical beneifts (small restaurants)

- Most everywhere the minimum wage they are paid does not afford a reasonable income, and a tip makes for survivable income

- In San Francisco, sometimes (with large enough collection of folks in a 'party') there is a flatrate percentage added to compensate the wait staff in lieu of a tip, but sometimes there is not, and a tip simply makes for reasonable income for the wait staff.

The healthcare benefit costs applicable to large enough food establishments located in San Francisco, which might (or might not) be itemized (of might be rolled into the food prices),

And then (entirely separate from food establishments) there are hotel taxes levied on top of room fees, separately calculated by hotel location..

About your first statement, that is in error...there is NO 15+% tax levied on goods! There can be 14-16% occupancy tax levied on hotel/motel stays, depending upon city.

- There is state tax which is a base (minimum) tax that applies everywhere in the state on goods (and could be collected by out of state businesses and then paid to CA for sales made to customers in individual cities...

- There might be additional local taxes, such as to pay for voluntary participation in certain transit districts or other local fees, which might add small incremental percentages (accumulating to about 2.7%) at most (though not limited by legislation) on top of the state tax....like L..A. at 9.38% total (this is inclusive of 7.25% segment going to the state).

For example, the combined sales tax rate for Alameda, California is 10.75%. The total sales tax rate is the sum of several components.

(The 2023 sales tax rate is highest in Alameda, California at 10.75%.)- the California state tax (6.25%),

- the Alameda County sales tax (1.00%), and

- special taxes (3.5%)

Last edited:

Ahem, we seem to have well strayed from the topic of photography here. Please make an effort to discuss the lenses situation.

Capn Jack

Gold Member

Then explain my posted bill for a hamburger. I showed two examples, and one calculates to the sum of California and San Francisco taxes- the number you gave earlier! I'll assume you fat fingered the key as you said the California tax was 7.25% earlier. Show me where the math is wrong? This is why I won't buy those two lenses in California (@Joeseph back to lenses)About your first statement, that is in error...there is NO 15+% tax levied on goods! There can be 14-16% occupancy tax levied on hotel/motel stays, depending upon city.

- There is state tax which is a base (minimum) tax that applies everywhere in the state on goods (and could be collected by out of state businesses and then paid to CA for sales made to customers in individual cities...

- There might be additional local taxes, such as to pay for voluntary participation in certain transit districts or other local fees, which might add small incremental percentages (accumulating to about 2.7%) at most (though not limited by legislation) on top of the state tax....like L..A. at 9.38% total (this is inclusive of 7.25% segment going to the state).

For example, the combined sales tax rate for Alameda, California is 10.75%. The total sales tax rate is the sum of several components.

(The 2023 sales tax rate is highest in Alameda, California at 10.75%.)

- the California state tax (6.25%),

- the Alameda County sales tax (1.00%), and

- special taxes (3.5%)

Similar threads

- Replies

- 0

- Views

- 148

- Replies

- 18

- Views

- 465

- Replies

- 6

- Views

- 308

- Replies

- 0

- Views

- 189

Share: